How to Build an Insurance App MVP That Attracts Users and Investors

The insurance market is changing faster than ever. Customers now expect digital convenience — quick quotes, one-tap policy renewals, and transparent claim tracking. That’s why forward-thinking brands are turning to MVP app and software development to test, learn, and launch smarter.

An insurance MVP development approach helps companies validate new ideas before investing heavily. It’s not just about saving time or cost — it’s about understanding what users really need. From on-demand insurance apps to AI-powered claim systems, MVPs are transforming the way insurers connect with their customers.

At Kuchoriya TechSoft, we specialize in creating scalable, market-ready solutions through insurance app development and InsurTech innovation. Our process blends strategy with technology — helping insurers move from concept to product with confidence and speed.

In today’s InsurTech era, building an MVP isn’t optional — it’s essential for staying relevant, competitive, and customer-first.

Before diving into coding or design, it’s essential to understand what an insurance app MVP really means — especially in today’s fast-changing InsurTech landscape.

1. Definition of MVP (Minimum Viable Product)

An MVP (Minimum Viable Product) is the simplest version of your digital product that includes only the core features required to test your idea and collect user feedback. For instance, an insurance MVP development in the USA might start with basic options like instant quote comparison, quick claim filing, and policy tracking.

2. The Purpose Behind Building an MVP

The main purpose of insurance MVP development is validation, not perfection. It allows startups and insurers to evaluate how users interact with the product before going for full-scale insurance app development — saving both cost and time.

3. Why It Matters in the Insurance Industry

The insurance industry deals with complex regulations, sensitive data, and constantly evolving user needs. Launching a full app without real-world testing can be risky. That’s why insurance app MVPs in Canada and InsurTech development in UK have become the standard approach for modern insurance innovation.

4. MVP = Speed + Savings + Smart Learning

An MVP for an insurance app helps companies release faster, collect insights sooner, and improve features with real user data — ensuring a higher chance of success.

Example: How Top InsurTechs Started Small

Major InsurTech startups like Lemonade (USA) and Breathe Life (Canada) began as MVPs to test their user onboarding process, build trust, and refine automation workflows. This smart approach proved that even small beginnings can lead to industry disruption.

At Kuchoriya TechSoft, we specialize in building insurance MVPs that balance technology and business goals. Our process ensures that every insurance startup MVP we create is fast, validated, and ready to scale globally.

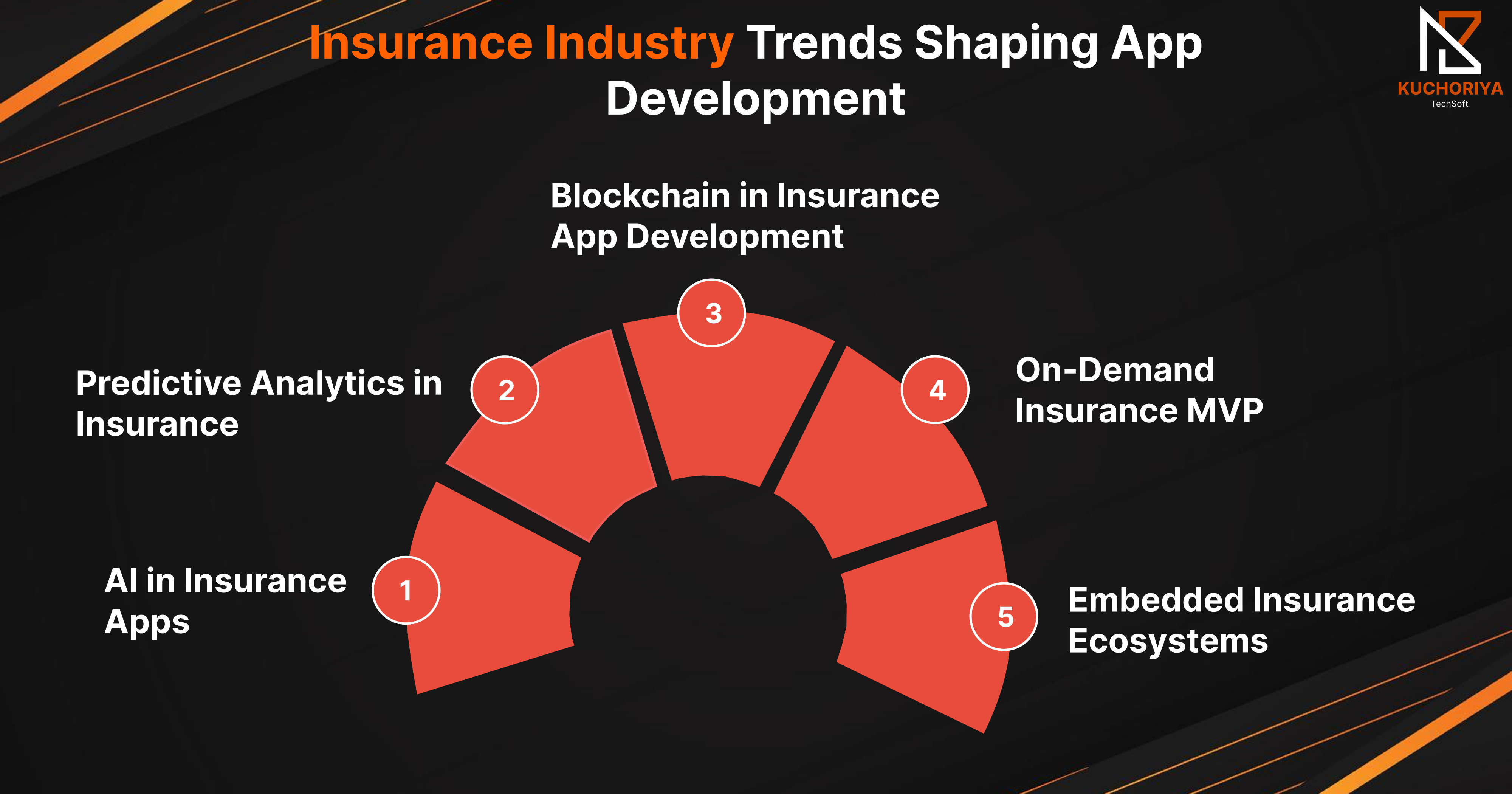

The global insurance industry is going through an exciting digital evolution. Businesses are investing in insurance app development and insurance MVP development to create smarter, faster, and customer-driven solutions. As a leading tech partner, Kuchoriya TechSoft helps insurance startups transform ideas into scalable products that align with 2025–26 market trends.

1. AI in Insurance Apps

AI in insurance apps is redefining how insurers handle claims and predict risks. From chatbots to smart underwriting, AI ensures efficiency and accuracy. At Kuchoriya TechSoft, our team builds intelligent insurance app MVPs that automate processes and enhance customer trust.

2. Predictive Analytics in Insurance

Predictive analytics in insurance helps companies personalize coverage using real-time data. A minimum viable product insurance app with analytics can identify user behavior and improve policy recommendations. We specialize in designing MVPs that help insurers test and refine these data-driven features quickly.

3. Blockchain in Insurance App Development

Blockchain in insurance brings unmatched transparency and security. It ensures tamper-proof policies and automated claim settlements. Our experts develop insurance MVPs in Dubai and other regions that leverage blockchain to reduce fraud and build user confidence.

4. On-Demand Insurance MVP

The on-demand insurance MVP trend is growing fast in the USA and Canada, giving users instant, flexible coverage options. Kuchoriya TechSoft helps startups launch MVPs that support pay-as-you-go insurance, helping them capture the modern, mobile-first audience.

5. Embedded Insurance Ecosystems

Embedded insurance allows users to buy coverage directly within apps like eCommerce or fintech platforms. It’s one of the strongest insurance industry trends 2025, and our insurance MVP development services help brands seamlessly integrate these solutions for faster growth.

Building an insurance app MVP isn’t just about coding — it’s about validating an idea fast while saving time and money. At Kuchoriya TechSoft, we follow a proven, data-driven insurance MVP development process trusted by global InsurTech startups in the USA, Canada, and Dubai.

1. Define Your Vision and Target Market

Start by understanding your audience and their pain points. During our insurance app development workshops, we identify gaps in existing products and align your MVP goals with user needs — whether you’re launching in the USA or scaling across Canada.

2. Research and Validate the Idea

Before writing a single line of code, validate your concept. Use surveys, landing pages, or prototypes to collect insights. Our team uses data-backed validation to ensure your insurance MVP idea resonates with investors and early adopters.

3. Design the User Journey (UI/UX Phase)

Great design drives trust. We craft clean, easy-to-navigate interfaces that reflect the professionalism of modern insurers. The UI/UX for insurance app MVPs focuses on clarity, personalization, and compliance — essential for digital transformation in insurance.

4. Select the Right Technology Stack

Choosing the right tools defines scalability. Kuchoriya TechSoft selects the most efficient tech stack for insurance app development, integrating APIs, cloud services, and AI features to support future growth and regulatory demands.

5. Build Core MVP Features

Start small, validate fast. The minimum viable product insurance app should include policy management, claims filing, a payment gateway, and notifications. Our developers focus on rapid insurance MVP development so you can test in real markets.

6. Test, Launch, and Collect Feedback

Once the prototype is ready, launch a closed beta. Measure KPIs like user acquisition and conversion rate to improve the MVP. Kuchoriya TechSoft ensures every insurance app MVP launch is backed by analytics and customer feedback loops.

7. Optimize and Iterate

Post-launch, use insights to fine-tune features and fix friction points. This iterative model helps achieve product-market fit faster — turning your MVP into a fully functional insurance app that investors can trust.

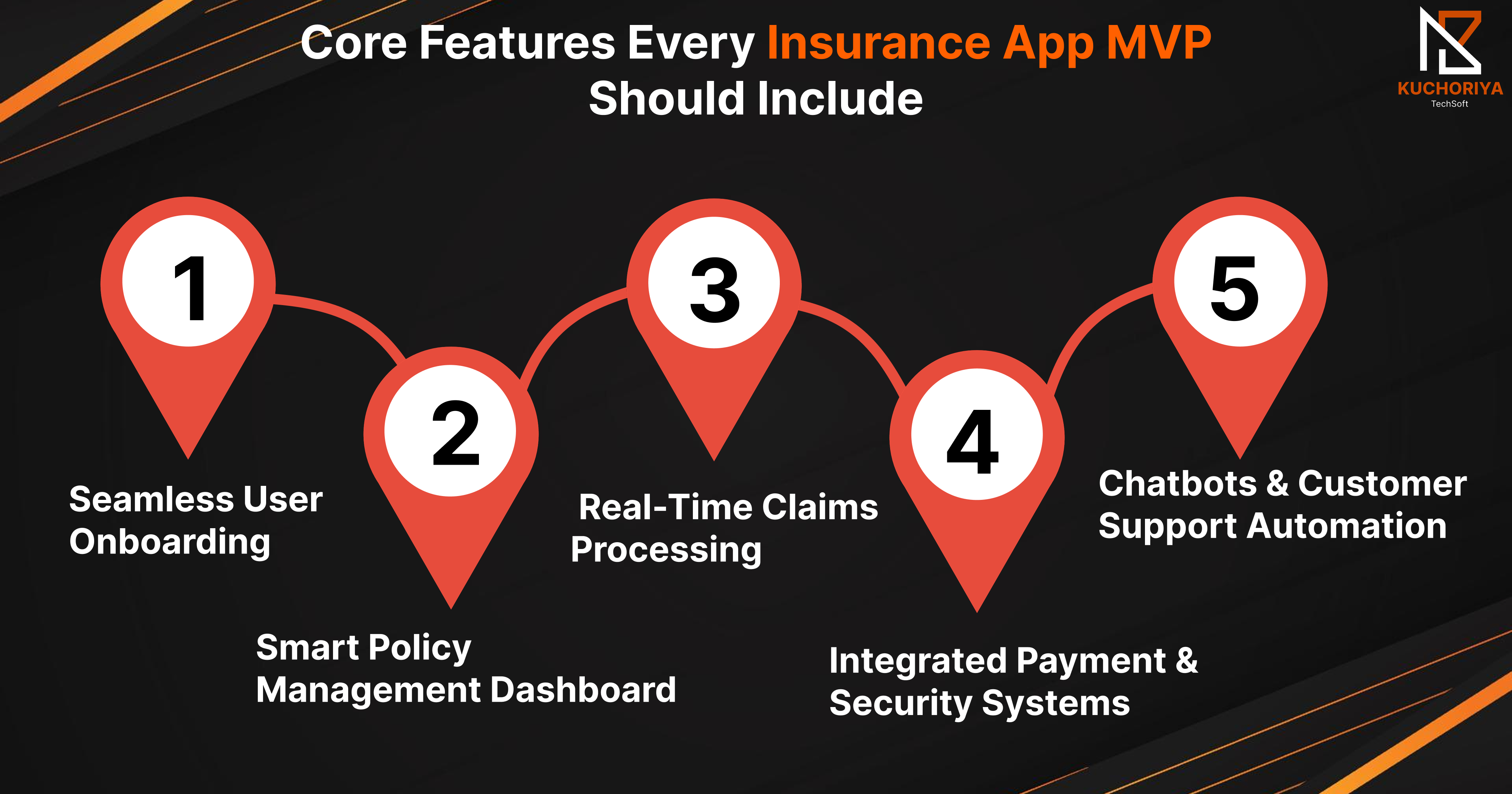

A successful insurance app MVP focuses on solving real customer problems while proving business viability. At Kuchoriya TechSoft, we craft user-driven MVPs that combine innovation, usability, and speed-to-market for the modern insurance landscape.

1. Seamless User Onboarding

Simple, quick, and secure sign-up with email, OTP, or social media login ensures better user acquisition for mobile apps and reduces early churn — essential for startup app development success.

2. Smart Policy Management Dashboard

An organized dashboard helps users view, renew, and track policies in real time. Integrated AI app development and predictive analytics in insurance make recommendations smarter and more personalized.

3. Real-Time Claims Processing

Our custom mobile app solutions enable paperless claims using blockchain in insurance for secure verification and faster approvals — enhancing digital transformation in insurance.

4. Integrated Payment & Security Systems

Using fintech app development principles, we add secure app development solutions like encrypted gateways and two-factor authentication to protect user data and ensure safe transactions.

5. Chatbots & Customer Support Automation

Powered by AI-powered app development, automated chatbots assist with FAQs, claims, and policy updates 24/7 — improving engagement and retention for insurance MVP development.

The right tech stack is the foundation of a scalable and secure insurance app MVP. At Kuchoriya TechSoft, we select modern tools and frameworks that boost performance, ensure compliance, and enable seamless feature expansion.

1. Frontend and Backend Development

Our developers use cross-platform app development tools like Flutter and React Native, supported by backend frameworks such as Node.js and .NET, to deliver flexible and high-performing mobile app development solutions.

2. Database and Cloud Infrastructure

We integrate cloud app development with AWS, Google Cloud, or Azure to ensure data safety and scalability. A robust database setup like MongoDB or PostgreSQL supports fast and secure insurance data management.

3. Security and Compliance Tools

Data protection is non-negotiable in insurance app development. We include secure app development solutions with encryption, blockchain integrations, and compliance with HIPAA and GDPR to maintain trust and transparency.

4. Analytics, AI, and Integrations

Our team leverages AI-powered app development, machine learning, and API integrations for predictive insights, automated underwriting, and improved customer engagement across insurance touchpoints.

Building an insurance app MVP doesn’t have to break your budget. At Kuchoriya TechSoft, we focus on cost-effective app development services that deliver maximum impact with minimal investment. Our approach ensures startups and enterprises can validate their product idea quickly and affordably.

1. Scope & Feature Complexity

The minimum viable product app focuses only on core functionalities like claims, policy management, and payments. Keeping features minimal can reduce the app development cost by nearly 40%.

2. Technology Stack & Integrations

Using open-source frameworks and cloud-based services during MVP app development cuts infrastructure expenses while ensuring scalability and reliability.

3. Design & User Experience

A simple yet clean UI/UX helps your MVP stand out without overspending. Our mobile app UI UX design team ensures every interaction feels premium even in the early version.

4. Location & Development Partner

Partnering with an offshore app and software development company like Kuchoriya TechSoft can save up to 60% of the total cost while maintaining top-tier code quality and delivery speed.

Average Cost Breakdown for Insurance App MVP (2025)

Pro Tip: Choosing a flexible app development agency like Kuchoriya TechSoft helps balance affordability, quality, and scalability — ensuring your MVP grows seamlessly into a full-scale product.

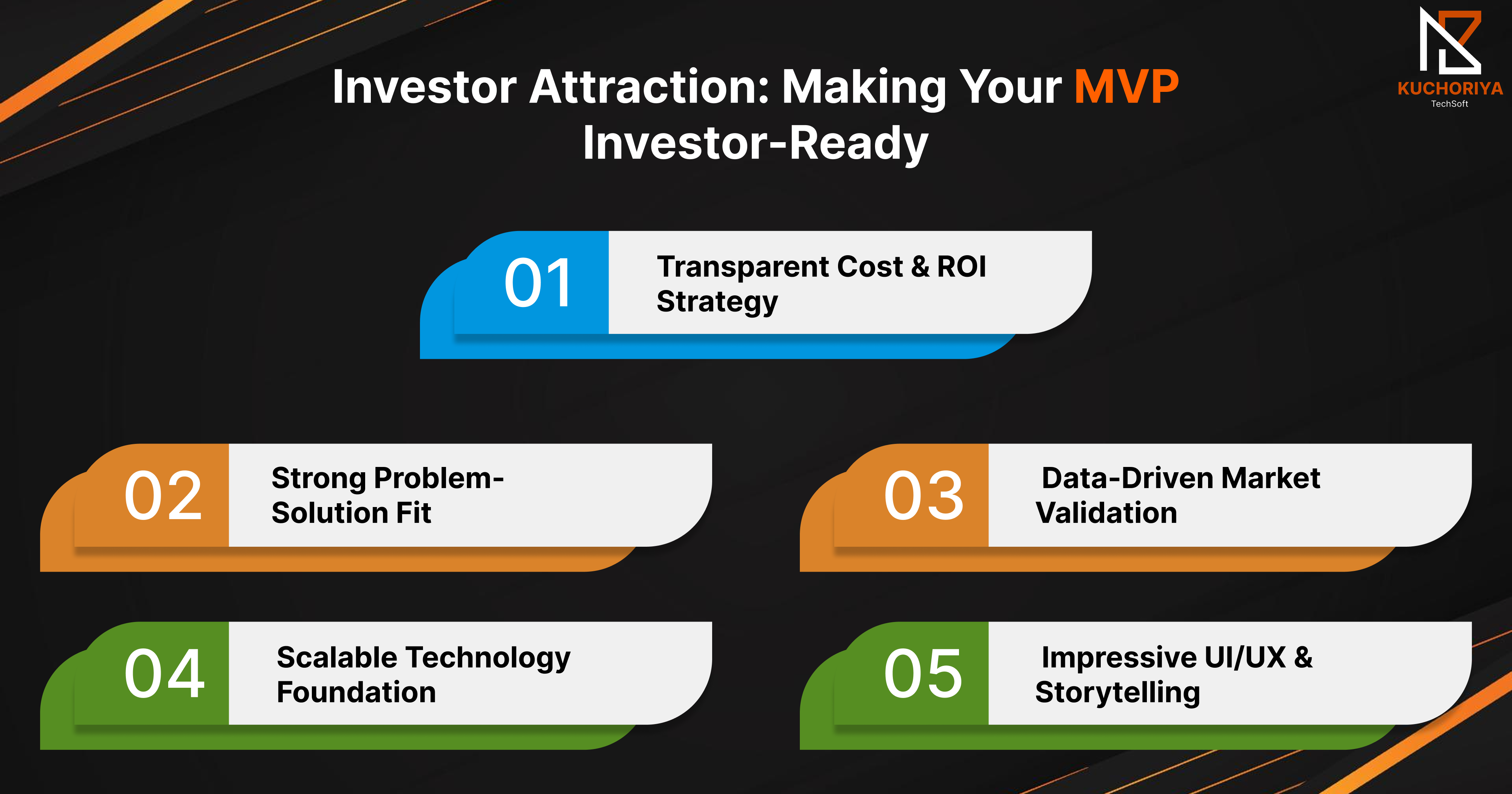

Building an MVP is only the first step — attracting the right investors defines its success. At Kuchoriya TechSoft, we help startups craft investor-ready app MVPs that combine innovation, validation, and scalability, making your product irresistible to venture capitalists and angel investors.

1. Strong Problem-Solution Fit

Investors look for clarity — your MVP must show how it solves a real insurance challenge. With our MVP app and software development process, we ensure the core problem and solution are proven through user feedback and data-backed results.

2. Data-Driven Market Validation

Our team builds app analytics and performance tracking into every MVP to gather insights on retention, engagement, and conversion. These real metrics make your minimum viable product app a powerful proof of market demand.

3. Scalable Technology Foundation

An investor-ready app MVP must demonstrate growth potential. Using cloud app development and AI-powered app development, we ensure your MVP can scale quickly once funding arrives — without costly rework.

4. Impressive UI/UX & Storytelling

A visually strong MVP backed by a compelling story converts more investors. Our mobile app UI UX design experts at Kuchoriya TechSoft create prototypes that visually communicate your value and market readiness.

5. Transparent Cost & ROI Strategy

We support you with detailed projections that highlight ROI, development timelines, and feature roadmap. With startup app development expertise, we help founders present confident, investor-friendly pitches.

💼 Why Investors Prefer MVPs by Kuchoriya TechSoft

We combine custom app development services with real market strategy — creating products that not only work but also win investor confidence. From fintech app MVPs to insurance app development, our approach builds trust and drives funding success.

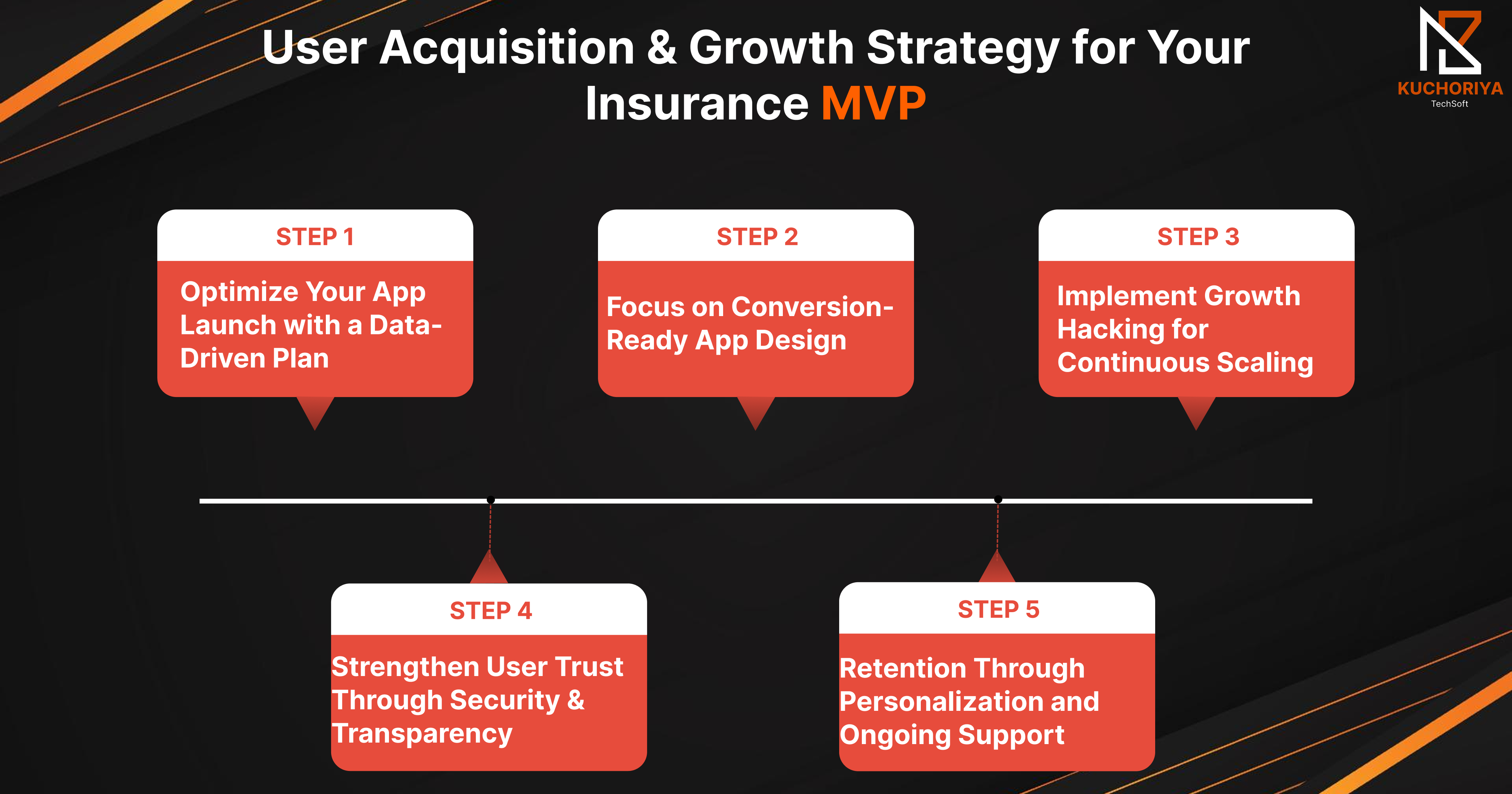

Building an innovative insurance app MVP is only half the journey — the real challenge lies in attracting and retaining users. At Kuchoriya TechSoft, we help startups design smart, scalable growth strategies that drive traction and long-term engagement across global markets like the USA, Canada, and the UAE.

1. Optimize Your App Launch with a Data-Driven Plan

Before release, ensure your mobile app launch strategy is backed by data and user insights. A solid pre-launch campaign, including targeted ads and social media buzz, can significantly improve early downloads and visibility for your insurance app development project.

2. Focus on Conversion-Ready App Design

A seamless mobile app UX design plays a crucial role in converting first-time visitors into active users. Use intuitive navigation, quick policy comparisons, and AI-driven recommendations to make your custom mobile app solutions more engaging and conversion-focused.

3. Implement Growth Hacking for Continuous Scaling

Growth hacking isn’t just for tech giants. Startups can implement app growth hacking strategies like referral programs, micro-incentives, and gamified user actions to boost signups. Our app analytics and performance-tracking tools help monitor userbehavior, refine user funnels, and reduce churn.

4. Strengthen User Trust Through Security & Transparency

Insurance users prioritize trust. By integrating secure app development solutions and cloud app development systems, you can assure customers that their personal and policy data are protected. Kuchoriya TechSoft ensures compliance and reliability at every stage.

5. Retention Through Personalization and Ongoing Support

Once you acquire users, retention becomes key. Using predictive analytics and automation, app lifecycle management keeps your MVP dynamic and responsive. Continuous updates, fast support, and tailored offers drive loyalty and maximize app development ROI.

Kuchoriya TechSoft combines cutting-edge digital product development with growth-driven marketing to help startups transform their MVPs into full-scale, revenue-generating applications. Whether your focus is on the insurance, fintech, or healthtech industry, our team builds strategies that convert users into lasting customers.

Once your insurance app MVP has validated the market, it’s time to evolve it into a scalable digital product. At Kuchoriya TechSoft, we help startups transition from MVP to full-scale applications with structured growth strategies and the latest tech integrations.

1. Move from Prototype to Full Product

After achieving product-market validation, expand your mobile app prototype development into a robust, enterprise-grade solution. Focus on enhancing features, scalability, and performance through app modernization services and advanced architecture.

2. Integrate Advanced Technologies for Competitiveness

To stay ahead, introduce innovations like AI app development, blockchain app development, or IoT app development. These upgrades enhance automation, data security, and personalization — key drivers in digital product development for the insurance industry.

3. Expand to New Markets and Platforms

Once your MVP gains traction, scale it globally with cross-platform app development and hybrid app development. Whether you’re targeting the USA, Canada, or Dubai, Kuchoriya TechSoft ensures seamless deployment through cloud app development and localization strategies.

4. Strengthen Post-Launch Performance and ROI

Sustained success depends on smart analytics and maintenance. With app support and maintenance services, app optimization, and enterprise mobility solutions, we ensure continuous improvements and measurable app development ROI as your user base grows.

Kuchoriya TechSoft partners with visionary startups to scale MVPs into profitable digital products that dominate competitive markets.

Must Read: Custom MVP Software Development: Launch Your Product Faster & Smarter

Every successful insurance tech giant started small — with a smart, data-backed MVP. At Kuchoriya TechSoft, we’ve helped numerous startups transform minimal prototypes into high-performing digital products that redefine user experience and attract investor attention. Here’s how strategic MVP scaling creates market leaders.

1. Lemonade – Reinventing Insurance with AI

Lemonade began as an AI-powered app development experiment aimed at automating claims. Their minimum viable product app introduced instant policy approvals and chatbot-driven claims — features that made insurance effortless and transparent. Today, Lemonade is one of the fastest-growing InsurTech startups globally.

2. Root Insurance – Personalization at Scale

Root Insurance leveraged AI in insurance apps and predictive analytics in insurance to personalize premiums based on driving behavior. Their MVP proved the power of usage-based models, turning Root into a benchmark for custom app development in the auto insurance space.

3. Metromile – Usage-Based Innovation

By introducing a pay-per-mile model through mobile app development services, Metromile disrupted traditional insurance pricing. Its on-demand insurance MVP became a symbol of innovation, helping customers pay only for what they use — an idea that reshaped the market for embedded insurance.

4. Kuchoriya TechSoft – Empowering Next-Gen Startups

At Kuchoriya TechSoft, our clients have built scalable MVPs in fintech, healthtech, and insurance app development. We combine startup mobile app solutions and offshore app development expertise to ensure each MVP is investor-ready, user-centric, and positioned for long-term market success.

These examples prove that an MVP isn’t just a product — it’s a growth engine. With the right partner like Kuchoriya TechSoft, your idea can evolve into the next global success story.

Developing an insurance app MVP may look simple on paper, but turning an innovative idea into a scalable, investor-ready product requires tackling several real-world challenges. At Kuchoriya TechSoft, our team specializes in solving these pain points through strategic planning, agile app development processes, and user-first design.

1. Complex Regulatory Compliance

Insurance apps must comply with multiple laws across regions. Meeting these regulations without slowing down the app development process is tough. Our experts ensure compliance from the first line of code, integrating secure app development solutions and GDPR-ready workflows for global launches — from the USA to Dubai.

2. Ensuring Data Security & User Trust

Handling sensitive policyholder data demands advanced encryption, secure APIs, and regular testing. Kuchoriya TechSoft’s app testing and QA services guarantee full data protection, while our cloud app development ensures safe, scalable storage solutions tailored for fintech and insurance MVP apps.

3. Balancing Cost with Quality

Startups often struggle to build high-quality products within limited budgets. With custom app development services and modular design frameworks, we reduce overall app development cost without compromising performance. Our transparent approach helps clients estimate realistic budgets using an internal app development cost calculator.

4. Achieving Product-Market Fit

A great app isn’t enough — it must solve real user problems. We validate every minimum viable product app through data-driven prototyping, mobile app UX design, and continuous testing to achieve strong product-market fit. This approach helps startups attract investors and scale faster post-launch.

Building a successful insurance MVP means overcoming these challenges strategically — and with Kuchoriya TechSoft’s proven app development solutions, you can move from idea to launch with confidence and speed.

The future of the insurance app development landscape is being redefined by innovation, data-driven decisions, and customer-first experiences. As InsurTech continues to evolve, building a minimum viable product app has become the smartest way for startups to validate ideas and attract investors before scaling.

At Kuchoriya TechSoft, we help visionary companies prepare for what’s next — combining advanced technology with proven app development solutions to create future-ready insurance MVPs.

1. Rise of AI-Powered Insurance Apps

By 2026, AI app development will dominate the insurance sector. From automated claim processing to predictive analytics, AI-driven MVPs will help insurers deliver personalized experiences faster and at lower costs. Our AI-powered app development approach ensures accuracy, automation, and real-time insights.

2. Blockchain & Transparency in Claims

Blockchain app development is making insurance processes more transparent and tamper-proof. Startups building insurance MVPs using blockchain will gain trust and faster claim settlements. Kuchoriya TechSoft integrates blockchain-led security within MVPs for secure app development solutions and regulatory compliance.

3. IoT and Real-Time Risk Assessment

Connected devices are transforming how insurance companies assess risk. Through IoT app development, insurers can monitor vehicles, homes, or health parameters in real time — making insurance app MVP development more data-driven and customer-centric.

4. Global Expansion of InsurTech Startups

The global mobile app development ecosystem will support insurance MVPs across markets like the USA, Canada, and the Middle East. With offshore app and software development and custom app development services, Kuchoriya TechSoft helps startups build scalable solutions that meet the needs of diverse markets and customer segments.

The next era of insurance belongs to those who innovate first. Partner with Kuchoriya TechSoft, your trusted mobile app development company, and let’s shape the future of InsurTech — one MVP at a time.

The app ecosystem is evolving faster than ever, and startups that adapt early will lead tomorrow’s market. Building a mobile app MVP is no longer optional — it’s the smartest way to test ideas, reduce costs, and achieve product-market fit. At Kuchoriya TechSoft, we specialize in app development and custom app development services tailored for every business, from fintech and healthtech to retail, travel, and e-commerce.

As a leading mobile app development company, we provide end-to-end app development services, including mobile app design and development, app testing and QA services, and app support and maintenance services. Our dedicated app development team focuses on creating scalable, investor-ready MVPs that bring your vision to life faster.

Whether you’re looking for cross-platform app development, native app development services, or hybrid app development, our experts use the latest tools to build seamless, high-performing solutions. We also offer AI app development, blockchain app development, IoT app development, and AR VR app development to ensure your MVP stays ahead of 2025’s innovation curve.

From on-demand app development to enterprise mobility solutions, Kuchoriya TechSoft is trusted by startups and enterprises across the USA, UK, Canada, and Dubai. Our offshore app and software development and custom app development USA solutions guarantee agility, affordability, and security.

As we move into 2026, investing in an MVP isn’t just about cost—it’s about unlocking long-term growth. Build your next minimum viable product app with a partner that delivers measurable ROI, scalable design, and lasting innovation.

Ready to take your insurance app MVP from concept to reality? Contact Us to specialize in designing investor-ready insurance MVPs that engage users from day one. Request a quote now to see how our expert team can help you validate your idea and accelerate growth. Want to expand your network? Join our referral partner program and collaborate with us for long-term success in the insurtech space.

Q. What is the process of building an MVP for a mobile app?

A. Building a mobile app MVP starts with strategy, followed by app wireframing and prototyping, mobile app UX design, and structured development. At Kuchoriya TechSoft, our app MVP development process ensures quick validation, cost efficiency, and effective app development solutions.

Q. How much does it cost to build a mobile app MVP in 2025?

A. The cost to build a mobile app depends on platform, features, and complexity. Using our app development cost calculator, clients can estimate accurate budgets. Our app development cost strategy for 2025 keeps MVPs affordable while delivering high-quality results.

Q. Why is MVP app development important for startups?

A. App development for startups minimizes risk while testing ideas. With startup app development strategies and MVP app launch support, startups can attract investors faster and maximize app development ROI.

Q. Which technologies are best for cross-platform and hybrid MVP apps?

A. Our cross-platform app development and hybrid app development solutions reach wider audiences with minimal effort. Kuchoriya TechSoft optimizes Android app development and iOS app development to ensure high-performance MVPs.

Q. Do you provide industry-specific mobile app development solutions?

A. Yes, we specialize in fintech app development, fintech app MVP, healthtech app development, healthtech MVP app, edtech app development, edtech mobile app solutions, e-commerce app development, e-commerce mobile app MVP, logistics app development, logistics delivery app MVP, banking app development, real estate app development, retail app development, travel app development, travel booking app MVP, food delivery app development, and SaaS app development—all tailored for your business needs.

Q. What makes Kuchoriya TechSoft the best mobile app development agency?

A. We are a global app development company delivering custom mobile app solutions, digital product development, and secure app development solutions. With top mobile app developers and a dedicated app development team, we are recognized as the best mobile app development company worldwide.

Q. Can I hire mobile app developers for long-term projects?

A. Absolutely! You can hire mobile app developers or assemble a dedicated app development team with us. We offer enterprise app development services, startup mobile app solutions, and app modernization services, making Kuchoriya TechSoft your trusted mobile app development agency.

HIRE A TOP SOFTWARE DEVELOPMENT COMPANY

We are all over the world

United State

9765 keystone court, Clarence, NY 14031 , USA, +1 (650) 488-7911

Canada

1100 Caven St., Suite PH11, Mississauga, ON L5G 4N3 Canada , +1 (416) 726-4662, +1 (650) 488-7911

Brazil

Bispo César da Corso Filho, 1266, San Carlos, São Paulo, Boa Vista, Brazil, 13575-331

South Africa

12 IbisWay, Sunnydale Fish Hoek 7985 Western Cape, South Africa, +27824507091

Spain

The Fir Tree 119 El Olmillo Residential Area Loranca de Tajuña 19141 Guadalajara, Spain

UAE

Building A2 DDP - Dubai Silicon Oasis - Dubai - United Arab Emirates

Italy

Viale dell'Esperanto, 71, Formia, Italy, Lazio IT

Singapore

01-08 50 Ubi Cres, Ubi TechPark, Singapore, 408568

Hong Kong

Tower 2, Silvercord, Rm 907, 9F, 30 Canton Rd, Tsim Sha Tsui, Hong Kong

Australia

Unit 14G, 3 darling point road, darling point, Sydney, NSW, Australia, 2027

India

C-15, 1st floor, Mahalaxmi Marg, Behind World Trade Park, Malviya Nagar, Jaipur, Rajasthan - 302017